About CVFM

We aim to connect students with real-world experiences as often as we can, and the CU Ventures Fund Management program is just one of the ways Concordia is preparing students for life after graduation. The CVFM program is an applied portfolio management program in which students learn equity research and portfolio management by making live trades and managing a live portfolio. The goal is to prepare students for careers in the investment management industry by combining academic training with a real-world experience of conducting research, making recommendations, executing trades, and managing a live portfolio.

We have outperformed the market for four years in a row.

The goal of the program is to prepare students for careers in the investment management industry by combining academic training with a real-world experience of conducting research, making recommendations, executing trades, and managing a live portfolio.

2023 CVFM Analyst Team (pictured from left to right): Jack Owen, Sam Muir, Brenden Rindhage, Alison Senkbeil, Breven Palpallatoc, Madeline Hillner, Dom Falcome, Isaac Bruins, Jeny Medel, Noah Jeseritz, Sean Durand, Hunter Auchtung, Isaiah Mengesha, and Professor Tom Scholz

2022 CVFM Analyst Team (pictured from left to right): Simon Liljegren, Colby Williams, Gabe Rodriguez, Jarod Ontiveros, Quinn Hoopman, Cade Neubauer, Scott Gregor, Vince Falcone, Rachel Yurske, Carson Lagina, Yannik Gruner, Professor Tom Scholz, Grant Karsten

2021 CVFM Analyst Team (pictured from left to right): Josh Cramlet, Andy Ellingham, Troy Stewart, Reece Elton, Zach Peppel, Andre Stewart, John Cole, Josh Weisel, Wesley Broillard, Daniel Rust, Nick Horschak, Salvatore Scalise, Grant Fox, Hunter Sadler, Derrick Folkman, Professor Tom Scholz, Ryan Jaffray, Devin Shibilski, Bobby McNealy, Jacob Verhelst, Tyler Drezik, Mike Gerschke

2020 CVFM Analyst Team (pictured from left to right): Sam Zarling, Professor Tom Scholz, Taylor Brittnacher, Jenna Tarnowski, Eric Sipiora. Not pictured due to covid-related photo delay: Samuel Bauer, Tyler Hottmann, Lars Emil Ihlen-hansen, Matthew Kaiser, Dylan Karvala, Bray Macintosh, Caleb Minx, Jacob Schulman, Connor Stoming, Cole Werning, Michael Wilcox, Christine Wilcox, Anna Wipperfurth, Leyun Zhang.

2019 CVFM Analyst Team (pictured from left to right): Andrew Otto, Terek Glenetski, Miguel Betancourt, Erik Landsverk, Andrew Barth, Dane Fronek, Christian Gerner, Owen Hanisko, Skylar Petrik, Karl Berg, Brittany Mani, Tyler Ryan, and Lu Lian.

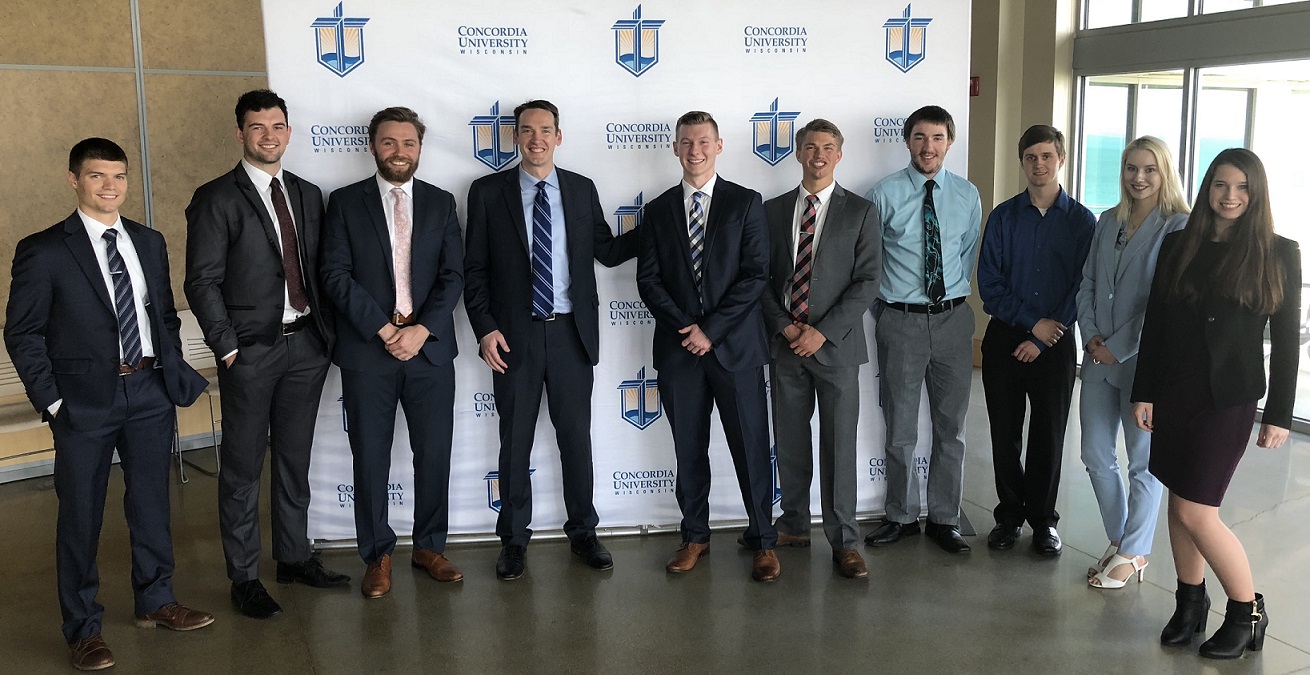

Fall 2018 CVFM Analyst Team (pictured from left to right): Parker Rome, Austin Halverson, Kory Boyd, Nick Covek, Ethan Danz, Trevor Nargis, Macy Hammen, Joshua Morales, Dena Guthrie, Kayla Schlosser, and Michelle Wolf

Spring 2018 CVFM Analyst Team (pictured from left to right): Colter Dziekan, Travis Marit, Eric Therrian, Professor Tom Scholz, Damon Mull, Isaac Palmer, Matthew Luft, Matthew Imig, Krystal Gould, Stephanie Wagner

Spring 2017 CVFM Analyst Team (pictured from left to right): Professor Tom Scholz, Kevin Jarvis, Drew Setzer, Emanuel Huerta-Gutierrez, Joe Carpenter, Nick Nayersina, and Travis Marit.

Our analysts screen our investment universe to create a manageable list of stocks organized in a way to highlight the most promising investment opportunities.

Each team member is assigned two to three sectors to cover, and he and she begins by combining sector and industry research with the previously described stock scoring to select stocks that merit deeper qualitative and quantitative research.

Once an analyst has completed a written research report, he or she presents his buy or sell recommendation to the team. Once a recommendation is approved, the team member buys or sells the position in our portfolio, housed in a Schwab brokerage account, with guidance from the faculty advisor.

The entire team is responsible for monitoring the portfolio’s returns and risk and adjusting the portfolio’s asset allocation to align with our return and risk objectives and constraints. This monitoring includes attribution analysis where we measure each decision’s impact on the performance of our portfolio vs. its benchmark, the Russell 1000 Index.

We will periodically present our portfolio performance and risk results to a panel of industry professionals for feedback.

All investment decisions will be made within the parameters of rigorous risk management discipline. In our investment theses, we pay special attention to the bear case, what could go wrong. We also believe the rigor of the recommendation process and team voting procedure provide an internal risk control function. We limit individual position sizes to limit the impact that one security can have on the total portfolio performance. At the portfolio level, we diversify the fund by holding a basket of securities and by maintaining diversification by sector.

We also follow strict trading procedures to eliminate the risk of trading errors.

Conducting the professional grade research required to make investment decisions requires a significant commitment of time spent in training, but also in independent research and collaborative decision-making. Professional quality research also requires fairly powerful and sophisticated software to access data and analytical tools to conduct research, to analyze and monitor our portfolio’s risk and performance, and to assess the impacts of our investment decisions.

We signed an academic license agreement to use the Morningstar Direct platform for our research and portfolio management needs. This software and data license agreement costs $10,500/ year, which is a steep discount to what it would cost an investment firm to purchase.

Want to get involved?

CVFM meetings are held periodically during the semester. The first portion of the hour-and-a-half meeting is dedicated to presentations and the last half hour is dedicated to collaborative work time. Students can expect to spend significant time outside of meetings conducting research and analysis, both individually and with other team members.

Questions? Contact Professor Tom Scholz, program director.